Funding International Banks with Your PayPal Account

In today’s interconnected world, managing finances across borders has become increasingly common. Whether you’re traveling abroad, conducting business internationally, or supporting loved ones overseas, having a reliable method to fund international bank accounts is essential. PayPal, a leading online payment platform, offers a convenient solution for transferring funds to international banks securely and efficiently. In this blog post, we’ll explore how to fund international banks with your PayPal account, step by step.

Understanding PayPal’s International Money Transfer Service

PayPal offers an international money transfer service that allows users to send money to bank accounts in over 200 countries and regions worldwide. With PayPal’s global reach and competitive exchange rates, users can transfer funds internationally with ease, whether it’s for personal or business purposes. Here’s how you can fund international banks using your PayPal account:

Step 1: Verify Your PayPal Account

Before you can send money to international banks, ensure that your PayPal account is verified. Verification typically involves linking a bank account or credit/debit card to your PayPal account and confirming your identity. Once your account is verified, you’ll have access to PayPal’s full range of features, including international money transfers.

Step 2: Add an International Bank Account

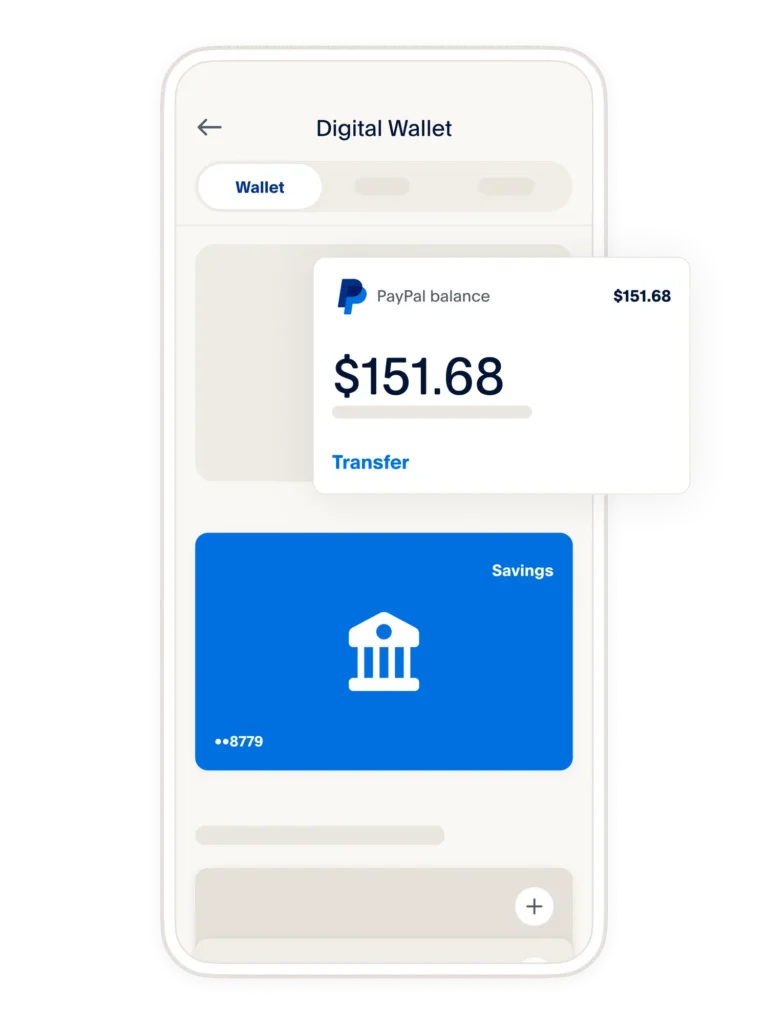

Next, you’ll need to add the recipient’s international bank account to your PayPal account. To do this, log in to your PayPal account and navigate to the “Wallet” section. Select “Link a Bank” or “Link a New Bank Account” and follow the prompts to enter the recipient’s bank account details, including the account holder’s name, bank name, account number, and routing number (if applicable).

Step 3: Initiate the Transfer

Once the recipient’s bank account is linked to your PayPal account, you can initiate the transfer. From the “Wallet” section, select “Transfer Funds” or “Send Money” and choose the option to send money to a bank account. Enter the amount you wish to transfer and select the recipient’s bank account from the list of linked accounts. Review the transaction details and confirm the transfer.

Step 4: Review Exchange Rates and Fees

Before finalizing the transfer, review the exchange rates and any associated fees. PayPal offers competitive exchange rates for international transfers, but it’s essential to understand the conversion rates and potential fees involved in the transaction. You may also have the option to choose between standard or expedited transfer speeds, depending on your preferences and urgency.

Step 5: Confirm and Track the Transfer

Once you’ve confirmed the transfer, PayPal will initiate the transaction, and the funds will be sent to the recipient’s international bank account. You’ll receive a confirmation email or notification once the transfer is completed. You can also track the status of the transfer directly from your PayPal account to ensure that the funds are delivered successfully.

Conclusion

Funding international banks with your PayPal account offers a convenient and secure way to transfer money across borders. By following these steps and leveraging PayPal’s international money transfer service, you can send funds to international bank accounts with ease, whether you’re supporting family members abroad, paying overseas vendors, or conducting business on a global scale. With PayPal’s global reach and user-friendly platform, managing international finances has never been easier.